Places for Discovery

CEO’s statement

“In a fast-growing sector, we are differentiated by our relentless focus on understanding our residents, both present and future, and curating an offer that speaks to their preferences and needs.”

Neighbourhoods that bring people together

This report reflects another important year for Get Living, not least for marking the first decade of our flagship neighbourhood, East Village, which has stood as the model for Get Living and the exemplar which many in the build-to-rent sector have sought to emulate. Together with our neighbourhoods in Elephant Central and Salford, the foundations for the next phase of growth are laid.

The year has been characterised by two contrasting themes. Demand for homes has been stronger than ever, resulting in record levels of occupancy, pricing, revenues, gross profit, and adjusted EBITDA. This is a testament to the quality of our homes and neighbourhoods, the compelling resident proposition we offer, the strength of the Get Living brand and the service levels delivered through our ever-maturing platform. In addition, the sale of the University Campus at Elephant and Castle Town Centre to the University of the Arts London (UAL) brought in £94.7 million of proceeds. We also delivered a new affordable housing block at East Village which was sold to Notting Hill Genesis.

By contrast, in line with most real estate assets, the valuation of the portfolio was lowered, as risk-free rates and related interest rates rose. By comparison with other sectors, the depreciation in value was comparatively resilient, but a 6.6% drop from a GAV of £2.73 billion to £2.55 billion is a correction that the trading profit cannot surmount.

Highlights

Continued growth

Financial and operational

- 2023 saw the 10th anniversary of Get Living operating at East Village, its flagship neighbourhood.

- Sustained rental growth across all operational assets saw rental income pass £100 million for the first time, totalling £106.9 million, up 28.2%.

- Overall revenue increased by 148.0%, driven by the sale of a new academic building to the University of the Arts London (UAL) in September 2023, and the subsequent development agreement with UAL.

- The Group’s net loss of £386.2 million was driven by a £333.2 million revaluation loss on the Group’s property portfolio due to challenging market conditions, in addition to the recognition of provisions for fire safety remediation. However, a disciplined approach to operational costs resulted in adjusted EBITDA increasing to £52.7 million from £31.8 million in 2022.

- The balance sheet remains strong with £1.08 billion (2022: £1.51 billion) of net assets with the decrease due to the revaluation loss and the fire safety remediation provision, 53.2% (2022: 47.2%) aggregate loan to value and weighted average maturity of debt is 6.0 years (2022: 6.5 years),

- The Group has identified pipeline opportunities in Maidenhead, Birmingham and Leatherhead. Get Living also secured approval to deliver 848 new rental homes and 504 student homes at East Village.

- The refinancing of the Portlands Place development loans was completed during the year, with the securing a £150.0 million facility with PGIM Real Estate.

- The investment of Aware Super into Get Living PLC demonstrates ongoing confidence in the sector and the strength of Get Living’s proposition.

- The first block at Newton Place, Lewisham reached practical completion in December 2023.

Environmental and social

- 48 new affordable homes developed by Get Living and sold to Notting Hill Genesis in 2022 were launched at East Village in 2023.

- The Lab E20 celebrated its second anniversary with a circular economy initiative. 2023 also saw the launch of a new creative and immersive space at East Village, Hypha Studios.

- Throughout 2023 we partnered with our supply chain to innovate the lifecycle of domestic furniture and kickstart a circular economy business model.

- Get Living ran a number of community initiatives across its neighbourhoods, including careers fairs at Castle Square.

- Get Living has partnered with TULU, a smart rental platform providing an on-demand self-service machine to residents allowing them access to rent or buy household items.

- Asset-specific ESG plans now established for all operational neighbourhoods.

Homes

0

0

2022

0

2023

Rental Income

£0m

+ 0 %

0

2022

0

2023

Net profit/ (Loss) (£m)

(£0)m

0

2022

(0)

2023

Portfolio value (£bn)

£0bn

- 0 %

0

2022

0

2023

Business Model

How we create value

Our purpose

We create value by building the exemplar BtR platform, driven by a clear vision and mission, creating sustainable neighbourhoods that are fit for the future and delivering long-term investor returns.

Our purpose is to create places that are sustainable and vibrant, places where people belong.

Our strategy

Our Neighbourhoods

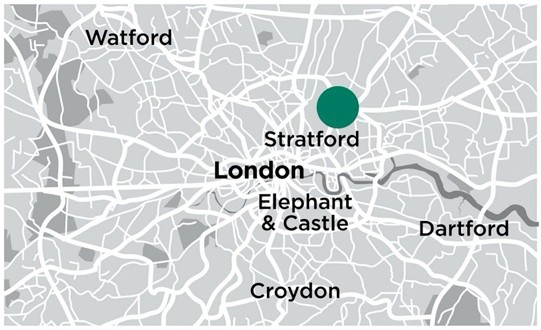

Flagship neighbourhood continues to grow

Our flagship neighbourhood, East Village, continues to thrive, a decade after it launched as the UK’s first large-scale BtR scheme. Setting the standard for professionally managed rental homes, East Village is now home to 6,500 residents, living in homes across the Olympic plots, Victory Plaza and, most recently, Portlands Place, which offers state-of-the-art amenity space.

In April, we completed 48 new affordable and energy efficient homes at Plot N05, which were handed over to Notting Hill Genesis to let to local residents at social rent.

East Village has become a hub for independent retail and creative concepts. Over 30 retailers are based at the neighbourhood, including Signorelli, Refill Therapy and new addition Eggslut, which has been highly popular since it opened its doors in October.

0

homes for rent

0

independent retailers

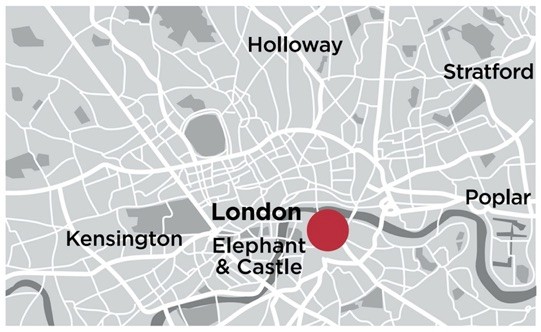

Neighbourhood living in the heart of London

The neighbourhood offers 374 rental homes and 278 student homes, along with several commercial occupiers including Gymbox, Sainsbury’s Local and independent restaurants TUPI, Pizzeria Pappagone and Murger Han.

Complementing the retail offer is nearby Castle Square, from which over 25 local traders operate. Situated next to Elephant Park, which regenerated part of Elephant and Castle with new homes for sale, retailers, restaurants and public realm, Castle Square hosts events throughout the year for the whole community to enjoy. As well as reflecting the cultural diversity and legacy of the local area, these events drive footfall into the centre of Elephant and Castle, supporting retailers and restaurant operators.

A number of building safety defects have been identified by recent inspections and work is ongoing to identify potential remediation works required, with all homes remaining safe to occupy.

0

homes for rent

0

student homes

Canal-side living between two cities

New Maker Yards, on the Salford-Manchester border, is now fully stabilised, following the opening of the second phase of homes in 2022. The 821-home neighbourhood is situated by the canal within Middlewood Locks, itself a highly popular area for families, professionals and students.

With a range of one to three-bed homes on the waterside, New Maker Yards appeals to a mix of sharers and families and is home to a total of 1,600 residents across six buildings. Residents benefit from exclusive use of an on-site clubroom and “The Lock”, the neighbourhood’s co-working space, and independent roaster and coffee shop, 92 Degrees. The commercial offer includes a local Co-op store and family-run beer house, Seven Bro7hers, which holds regular events and pub quizzes.

A highly sociable neighbourhood, resident events at New Maker Yards are well attended. Along with the bio-diverse canal-side setting, the homes at New Maker Yards are highly energy efficient, with over 95% rated B on EPC.

0

homes for rent

0

acres

Newton Place, Lewisham

A dynamic, vibrant new London neighbourhood

Now known as The Filigree

Located in London’s Zone 2, Newton Place in Lewisham marks our third London neighbourhood and will deliver 649 brand new homes for the city, including 119 co-living homes and 106 affordable homes.

Practical completion will take place in Q3 2024, with good progress made in 2023. The neighbourhood’s first residents will move into their homes from summer 2024, with options from co-living studios to three-bed apartments, and a number of state-of-the-art rooftop homes on the 16th floor, which offer amazing views across the city.

On the ground floor, residents and the wider community alike will be able to enjoy a brand new retail, leisure and food and beverage destination, with ten retailers in advanced talks to take the 40,000 sq ft of commercial space. This will form part of a distinctive leisure offering, supporting a new night-time economy in Lewisham in a thriving, safe setting. Running through the neighbourhood will be the new public realm, including a public square for events and trading opportunities, adding to the existing offer which includes nearby Blackheath Common and Greenwich Park.

Newton Place is part of a wider regeneration project in Lewisham, which has seen it attract significant investment and become one of the capital’s up-and-coming regions.

0

homes for rent

0

co-living homes

0

sq ft of commercial space

Elephant and Castle Town Centre

A new town centre is emerging

One of London’s highest value and technically complex regeneration projects, Elephant and Castle Town Centre is set to be a major new destination in the heart of the city. On track to complete in 2026, the scheme will deliver almost 500 new homes for rent, of which 172 will be affordable, 135,000 sq ft of shops, restaurants, cultural and leisure space, 55,000 sq ft of workspace and a state-of-the-art new campus for University of the Arts London (UAL). The public realm will be completely transformed with three new streets, new central public square and extensive landscaping for the whole community to enjoy.

The development will also deliver major infrastructure improvements to public transport, including a new entrance to the Northern Line Underground providing both escalator and lift access and designed to unlock the opportunity for a potential future Bakerloo line extension.

With the placemaking and brand strategy in development, construction is making good progress. At the end of 2023, the fourth construction stage, the main works super structure is well underway. This is expected to progress to the commencement of main works fitout in October 2024.

0

homes for rent

0

acres

ESG at Get Living

ESG strategic framework

To preserve and grow the value of real estate assets and meet expectations of customers, capital and debt providers, colleagues and the communities in which we invest, a proactive ESG response is essential. Managing climate risks and transitioning to more sustainable development and operational ways of working is an asset management imperative. Shaping the homes in which people live, the way they travel, work, shop and play, gives Get Living a platform from which to drive changes needed in the face of climate and ecological disaster. Six strategic objectives guide our direction of travel over the next five years.

Protecting and enhancing our environment

Employ whole-life impact considerations to improve the performance of our existing neighbourhoods, and to future-proof new developments

- Demonstrable downward trends in energy use, emissions intensity, water intensity and waste to landfill Improved benchmarking and ratings for both development and operational assets

- Neighbourhoods built to last, founded on strong sustainability credentials and continuous improvement through retrofits and refreshes

- Residents and tenants who are connected with our ESG agenda, and taking action to live more sustainably

Protect and enhance biodiversity both in our neighbourhoods and remotely, promoting a connection to nature

- Biodiversity net gain and urban greening we can communicate to stakeholders

- Water management that helps us to manage growing water scarcity and protect water courses

- Public realm designed for both people and nature

- Residents and tenants who have an increased connection to nature and partnerships that enable them to take action to enhance biodiversity

Delivering social value

Celebrating the individual personality of our neighbourhoods, and embracing the locality, to evoke a strong sense of place for our residents, locals and visitors

- Activated amenity spaces that inspire activity and support the health and wellbeing of our residents

- Increased access to urban nature for residents and local people

- Recognised for having safe, welcoming and accessible spaces

Optimise the local socio-economic benefits of our developments and operations

- Focus on material impact areas, delivering greater impact

- An understanding of local needs and a social value programme that responds to these

- Stronger, longer-lasting charity and local partnerships that leave a lasting impact on their ability to deliver against local need

- Programme of activities and enlivenment at each neighbourhood that deliver local socio economic benefits

Progressive governance

Cultivate an internal culture and skill base that supports a progressive and determined approach to delivering positive social and environmental changes

- Establish clear targets and enhance data management systems to monitor performance effectively, offer constructive feedback, and acknowledge achievements

- Enhance and understand the skills and motivation of our colleagues, empowering them to effectively contribute towards meeting our ESG objectives

- Develop a comprehensive understanding of our stakeholders and value chain, fostering relationships essential for advancing our ESG goals

- Encourage engagement in ESG initiatives across different roles by establishing working groups and implementing objectives tailored to each role’s responsibilities

Shape and deliver responsible and accountable ESG governance practices as an operator and developer

- Activated amenity spaces that inspire activity and improved stakeholder engagement throughout value chain

- Reporting and disclosures that respond to the regulatory environment of our investors

- Improved data quality through automation, monitoring systems and assurance

- Risk and opportunity management that positions us strongly when responding to Task Force on Climate-related Financial Disclosures (TCFD) and Taskforce on Nature-related Financial Disclosures (TNFD)