Get Living, the UK’s leading build-to-rent operator of large-scale residential neighbourhoods, has secured a £110 million investment facility with Rothesay to refinance its New Maker Yards neighbourhood in Salford, Greater Manchester.

Rothesay is the UK’s largest pensions insurance specialist with over £60bn of assets under management, securing the pensions of almost one million people. The successful transaction represents Get Living’s first with Rothesay and its largest financing facility to date outside of London, as demand for build-to-rent (BtR) continues to grow in the UK’s major regional cities.

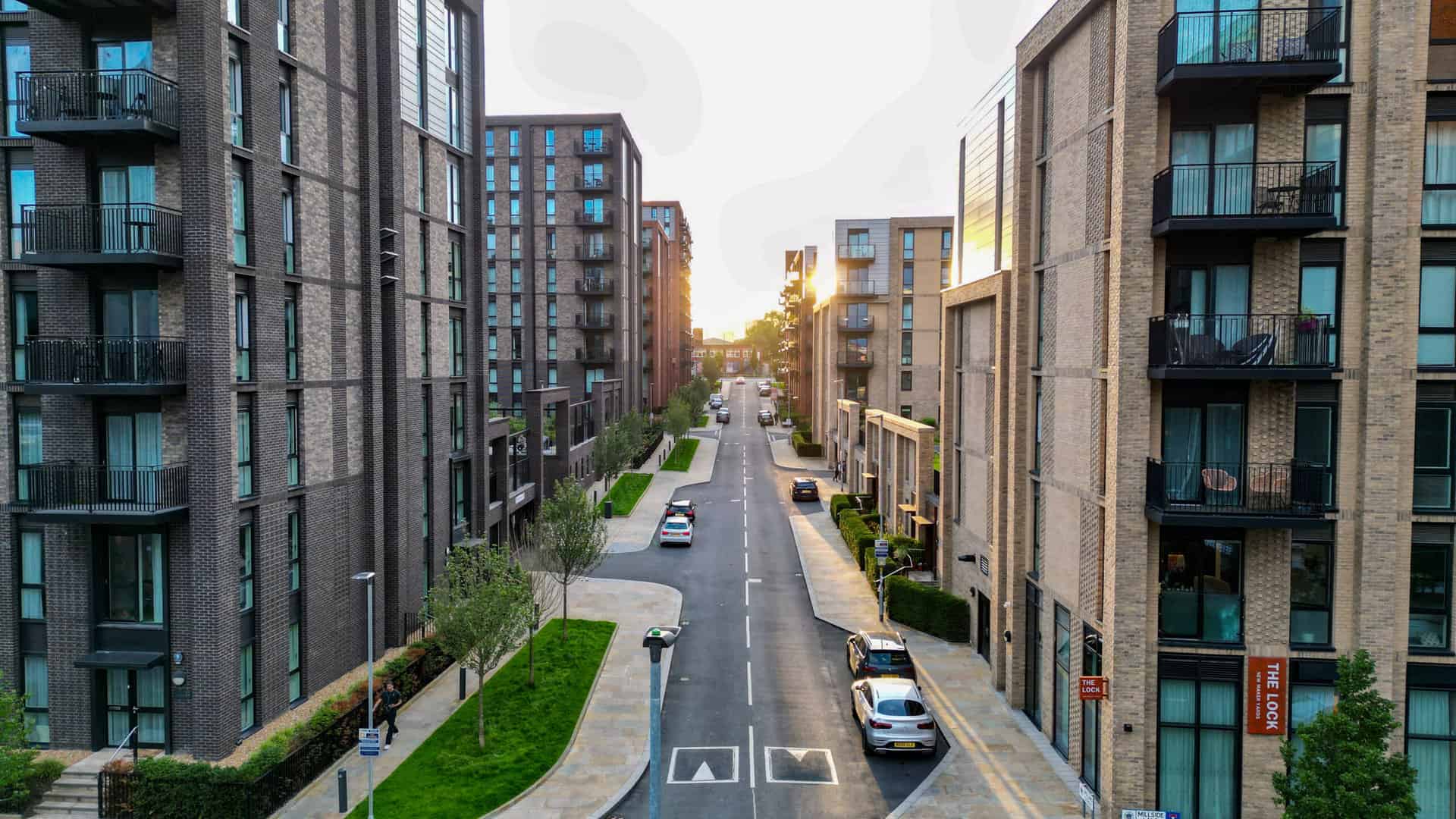

Located on the Salford-Manchester border, New Maker Yards has 821 homes with 1,600 residents. As at the end of January 2024, the canal-side neighbourhood was 96% occupied. It offers over 11,000 sq ft of commercial space along with exclusive resident amenities including The Lock, a new co-working and socialising space. Situated close to Manchester’s city centre and its universities, New Maker Yards is highly popular with both young professionals and students.

The financing follows a recently completed deal for Get Living’s Portlands Place scheme in East Village, Stratford. In April 2023, Get Living also welcomed Australian superannuation fund Aware Super as a shareholder, with its purchase of a 22% stake in the business. Aware Super joined Get Living’s other long-term institutional investors, APG and DOOR.

Dan Greenslade, Chief Financial Officer at Get Living, said: “We are delighted to have Rothesay on board at New Maker Yards. Securing a financing partner of this calibre is testament to the strength of the offer at the neighbourhood and reflects long-term confidence in the wider BtR sector. Demand for high-quality, professionally managed homes for rent in the UK’s regional cities is only set to increase as people of all demographics seek a better rental experience.”

Harish Haridas, Head of Commercial Real Estate Debt at Rothesay, said: “Rothesay’s investment strategy is focused on securing high-quality, long-term assets to protect the pensions of our almost one million policyholders. Our dedicated in-house investment team enables us to find the right type of opportunities, like New Maker Yards, which deliver predictable returns while also supporting wider stakeholders and society. We’re pleased to finance this development which will support prime rental and commercial opportunities within a vibrant new neighbourhood in Greater Manchester.”

Cushman & Wakefield, Gibson Dunn, Harneys, and BCLP advised on the transaction for Get Living.

In addition to its three operational neighbourhoods at East Village in Stratford, Elephant Central in London and New Maker Yards in Salford, Get Living has a secured pipeline of an additional 6,500 homes in major urban centres across the UK, including Birmingham and London.